Valentine’s Day was tough on New Yorkers who hoped to benefit from the more than 20,000 new jobs from Amazon’s move there (not to mention all the additional jobs from construction and supporting the new employees). For others, the event is the hoped-for moment where the relative power of corporations, governments and labor shifts back to governments and possibly labor. Expect those who protested against Amazon’s breaks to be disappointed. Instead, the move will be seen as evidence of corporations continuing to gain strength.

Corporations have benefited from large gains in power relative to both governments and labor in recent history. And that power is very strong right now. As New York City Mayor Bill de Blasio complained after Amazon’s decision to pull out of the deal with NYC, saying “Amazon just took their ball and went home.” He also referred to the move as an “abuse of corporate power.”

Government, Labor, and Corporations – Strange Bedfellows

The late 1970s and early 1980s represented a major change in direction in the relationship between government, labor, and corporations. President Ronald Reagan, Prime Minister Margaret Thatcher and Chairman Deng Xiaoping all sought to increase business activity by lowering taxes and deregulating industries.

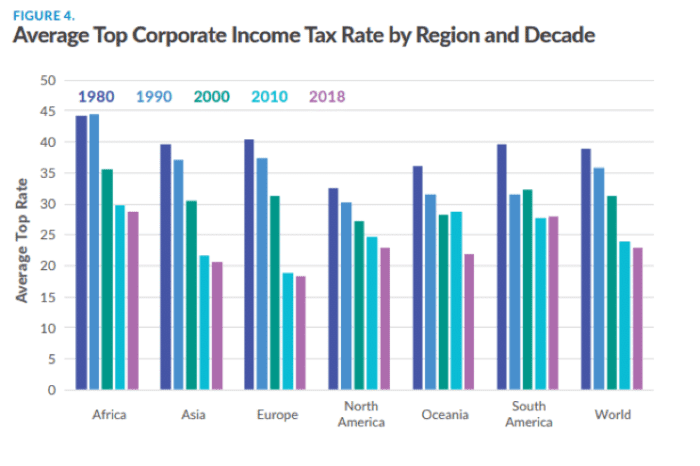

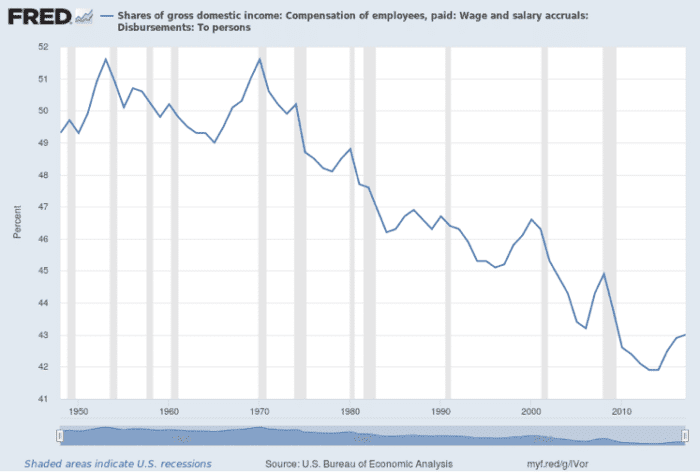

The idea was that inflation would be better contained and economies would grow more rapidly. The two charts below show this point well.

The global average top income tax for corporations was just under 40 percent in 1980. Today, the top rate in the U.S. is less than 25 percent, and that doesn’t include all the tax code changes designed to spur investment in exchange for lower taxes. The other chart shows how the share of gross domestic income paid in the form of wages and salary accruals has dwindled from around 50 to 43 percent since the early 1970s.

These trends have continued unabated. The potential to bring additional jobs to an area creates enough benefit that municipalities, states, and countries are willing to offer large benefits to corporations. While Mayor de Blasio says Amazon “took their ball and went home,” a more accurate description is they went to play with people who would happily play on Amazon’s terms. Given the huge number of entrants in the Amazon sweepstakes, there’s no shortage of other options.

Amazon HQ2 may prove to be the peak of corporate power. But the concentration of economic gains on the coasts leaves many cities in the middle of the country very anxious to attract businesses that will bring a large number of high-paying jobs with them.

The low unemployment rate has given a boost to wages in recent years. But wage growth has been slow and workers have been reluctant to switch jobs or move to pursue higher wages.

Long-term investors should continue to expect favorable treatment for their investments relative to governments and labor. The benefits from jobs will continue to make both those groups easy negotiating partners in most places. For the opposition, Amazon’s withdrawal will be a Pyrrhic victory.