We always try to explain risk tolerance and investing in an easily understandable way. For most people, investing in their 401(k) has been their only experience investing, so their knowledge of investing as a whole is limited.

An emoji guide to investing may not be the first thing you think of, but it relays a message any investor can relate to. The non-emotional investor – the steady emoji below – who sticks to a plan and knows their risk tolerance has the highest probability for long term success.

Keeping the image above in mind, how can you prepare yourself for volatility? Human beings have short memories, especially when it comes to investing. When everything is going great in the low market volatility investors seem to forget and tend to get more aggressive with their investments. The reverse is true as well: when everything is going badly in the market coupled with high market volatility, investors suddenly become more conservative.

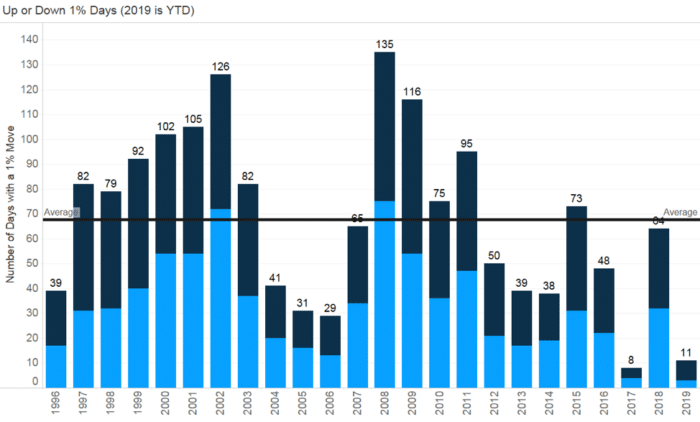

A successful active investor should do the exact opposite. Let’s take a look at what history shows us. The chart below shows the number of +/- 1 percent or greater one day moves in the market per year (dark blue being up days and light blue being down days):

Chart created by Scott Kubie, Senior Investment Strategist at Carson Wealth

When you look at the chart the first thing you may notice is the average number of +/- 1 percent or greater one day moves in the market: 68. It seems like a lot, especially since the past seven out of eight years have not reached the average.

2017 was the lowest in history and provided 20 percent plus return for the market, while 2008 had the most in history when the markets saw a near 40 percent decline.

Our advice to investors is to realize times of high market volatility nearly always follow times of low volatility. Accept that there is going to be market volatility, and it will come in different forms each and every year. Know your risk tolerance and stick to your plan, and you can survive the rollercoaster of emojis!

Take our risk tolerance questionnaire and speak to an advisor to confirm you are on track.

The information provided in this article is not intended to provide specific advice and should not be construed as a recommendation for any individual. To determine which investment may be appropriate for you, consult with your financial, tax or legal professional. There are no guarantees any investment or strategy will meet its intended objective.

![market volatility, financial planning, [PARTNER FIRM] Management, Omaha, Nebraska](https://carsondemo.com/wp-content/uploads/sites/212/2019/05/blog-feature-image-4.jpg)