By Jamie Hopkins, Director of Retirement Research

As you move toward retirement, you can’t be content just to accumulate assets. You need to develop a retirement income plan that can help guide you when it comes time to turn savings into sustainable retirement income. The real challenge of retirement income planning is that you need to generate income for an uncertain period of time – uncertain because no one knows how long they’ll live in retirement.

As such, one of the most important retirement income resources is Social Security, which provides inflation-adjusted income for life to retirees. Making the correct Social Security-claiming decision within the construct of an overall retirement income plan that includes spending needs, longevity and tax planning could mean the difference between meeting your retirement goals or not.

While SS does also provide survivor and disability benefits, 73.2% of SS benefits are paid to retired workers and their dependents. It remains a major source of income for retirees, as nearly 90% of those over age 65 receive SS benefits. Roughly half of all married couples and nearly 70% of unmarried persons receive 50% or more of their retirement income from SS. However, the average monthly benefit in 2019 is only $1,471, meaning many retirees get by on less than $20,000 a year ($17,652 to be exact).

In order to qualify for your own SS retirement benefits, you pay into it through a payroll tax system. Today, employers and employees each pay 6.2% of wages up to the taxable wage base of $132,900 ($137,700 in 2020). If you are self-employed, you then pay both the employer and employee sides (12.4%). Ultimately, these earnings you pay taxes on help determine your benefit at full retirement age.

Even if you start to collect SS benefits, if you continue working, you will continue to pay into the system. Additionally, if you keep working into your 70s, you could increase your SS benefits by replacing lower years of income with higher years of income. However, it is important to note that for self-employed individuals working after they collect SS, there is no reprieve from the substantial 12.4% tax, even if you already collected benefits.

How Social Security Is Taxed

While many people are aware that they pay into the system each year through a payroll tax, few understand that SS benefits can be subject to income taxes when claimed. SS benefits can become taxable if you earn more than certain “provisional income” thresholds. Provisional income, also referred to as combined income, is your modified adjusted gross income (MAGI), plus tax exempt interest (like from municipal bonds), plus half of your SS benefits.

Once your provisional income is determined, your SS benefits could be subject to taxation based on certain income levels. Up to 50% of your benefits can be taxed at your current tax rate if your provisional income is between $25,000 and $34,000 for an individual and $32,000 to $44,000 for a married filing jointly couple. In other words, if you can keep your provisional income below $25,000 as an individual or $32,000 as a couple, you can keep all of your SS benefits from being taxed at the federal level.

However, for individuals with more than $34,000 of provisional income – and for married filing jointly couples with more than $44,000 – up to 85% of your Social Security benefits can be subject to your current income tax rate. Check out this IRS worksheet to calculate how much of your Social Security benefits might be subject to federal income taxation. And federal taxes aren’t the only ones to watch out for. While most states do not tax Social Security benefits, a handful of states do place income taxes on them.

How to Reduce Your Social Security Taxes

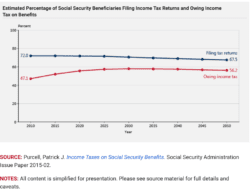

While roughly 50% of those receiving benefits pay no income taxes on them due to the fact they fall below the income limits, the other 50% of retirees do pay. For the half that pays, better planning could help increase your cashflow by reducing taxes.

Because Social Security benefits are taxed based on provisional income, one way to improve your tax outcome as it relates to Social Security is to lower your MAGI. Distributions from IRAs and 401(k)s are often taxable. As such, they raise your tax rates and taxable income.

Furthermore, once you hit age 70.5, you could be subject to RMDs, which can force out taxable distributions, which could cause both the dollars distributed and your SS benefits to be taxed. Instead, of falling into this RMD tax trap, take advantage of Roth conversions during early retirement years or pre-retirement.

Roth IRAs and conversions can add two different benefits related to SS tax planning.

- Roth IRAs are not subject to RMDs at age 70.5 for the Roth IRA owner. This gives people more control over their money in retirement.

- Because there are no RMDs (and because Roth IRA distributions are typically non-taxable), any money retirees need for spending can come out of the Roth and not increase MAGI.

As such, Roth money can help keep your provisional income under control and SS benefits from being subject to taxation.

Other Tax-Free Income Sources

Other types of strategies can also provide non-taxable cash flow in order to support spending needs in retirement. By tapping into non-taxable income sources, a retiree can help keep their spending steady and even perhaps increase their cash flow by reducing taxes on Social Security.

HSAs, for instance, can provide tax-free distributions for funding health care expenditures in retirement. Reverse mortgages – while they are a form of borrowing that comes with costs and are not for everyone – can provide a way for retirees to tap into home equity to support spending needs or reduce expenses without having a taxable income event. Additionally, certain insurance products like long-term care insurance can provide income-tax-free cash flow to help cover long-term care costs.

Lastly, non-MEC permanent life insurance policies can have cash value build up internally that can be tapped into to support retirement spending needs without causing a taxable event. This can again allow a retiree to support their retirement income needs without raising taxable income and therefore help keep tax rates lower and maybe help keep SS benefits from being taxed.

In the end, SS and tax planning is complex and cannot be done in a silo. It needs to be incorporated into a comprehensive retirement income plan that looks at the individual’s needs, wants, assets, longevity and other risks that might derail retirement.

Be proactive and plan ahead in order to get the most out of your valuable SS benefits. There is no reason to pay more taxes than legally required. A little proactive planning can go a long way toward maximizing your benefits and minimizing your taxes.

Converting from a traditional IRA to a Roth IRA is a taxable event. A Roth IRA offers tax free withdrawals on taxable contributions. To qualify for the tax-free and penalty-free withdrawal or earnings, a Roth IRA must be in place for at least five tax years, and the distribution must take place after age 59 ½ or due to death, disability, or a first time home purchase (up to a $10,000 lifetime maximum). Depending on state law, Roth IRA distributions may be subject to state taxes.

For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Tax services are not available through CWM, LLC nor Cetera Advisor Networks LLC.